|

|||

|---|---|---|---|

|

|

|

|---|---|---|

|

||

|

|

|

|

|---|---|---|

|

How to Repair Your Credit Fast: A Comprehensive Guide

Repairing your credit swiftly is often a top priority for many individuals seeking financial stability and freedom. While the task might seem daunting, it is entirely achievable with a strategic approach. Here, we delve into practical steps you can take to improve your credit score in a relatively short period.

Understanding Your Credit Report is the first critical step in repairing your credit. Obtain a copy of your credit report from the three major credit bureaus: Equifax, Experian, and TransUnion. Reviewing your credit report allows you to identify any inaccuracies or outdated information that may be negatively impacting your score. It's not uncommon to find errors, and disputing them could potentially lead to a significant score increase.

Paying Down Debt should be your next focus. High credit card balances can drastically affect your credit score due to their impact on your credit utilization ratio. Aim to reduce your credit card balances to less than 30% of your available credit limit. This not only improves your credit score but also signals to lenders that you are a responsible borrower.

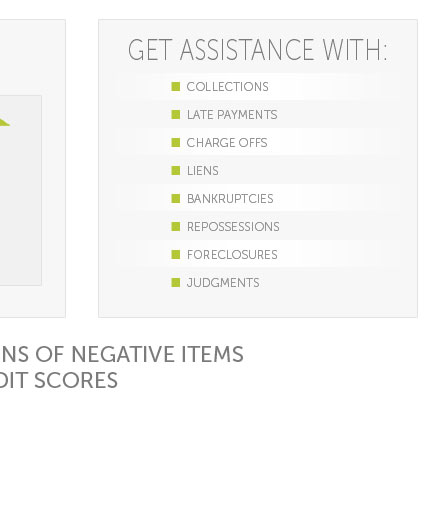

Another vital strategy is to make all your payments on time. Late payments can be detrimental to your credit score, and unfortunately, they can linger on your credit report for years. Setting up automatic payments or reminders can ensure that you never miss a payment deadline.

For those who have collections on their credit report, it might be beneficial to negotiate with creditors. Sometimes, creditors are willing to remove a collection from your report if you settle the debt. It’s worth contacting them to explore your options.

Additionally, consider the benefits of becoming an authorized user on someone else's credit card account, ideally someone with a strong credit history. This can help you build credit, especially if you lack a robust credit history of your own. However, ensure that the primary cardholder maintains good credit practices, as their negative actions can also impact your score.

Some experts suggest diversifying your credit mix. This doesn't mean taking on debt recklessly, but having a blend of credit types (such as installment loans and revolving credit) can potentially boost your score. Be cautious, though, as opening too many new accounts in a short time can be seen as risky behavior by lenders.

Regularly monitoring your credit is crucial throughout this process. Keeping a close eye on your credit score changes and the factors affecting it can help you make informed decisions and adjust your strategies as needed.

In conclusion, while repairing your credit fast involves a series of strategic moves, patience and persistence are key. With deliberate actions and consistent monitoring, you can significantly improve your credit score, paving the way for better financial opportunities and peace of mind.

While there is no instant fix for your credit, the strategies outlined above can set you on the path to a healthier credit score if used the right way.

Check Your Credit Score & Report - Fix or Dispute Any Errors - Pay Your Bills On Time - Keep Your Credit Utilization Ratio Below 30% - Pay Down Other Debts - Keep ...